HD94 ACC1100 Summary Notes

Subject notes for Monash ACC1100

Description

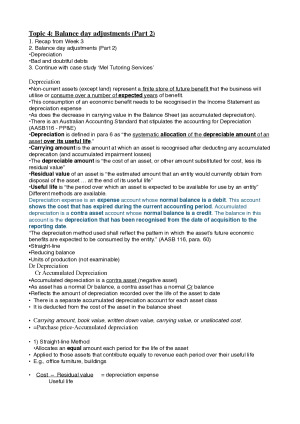

12 weeks covered Topic 1: Introduction to accounting and conceptual framework Topic 2: The recording process (Part 1): Double-entry accounting, general journal, and ledgers Topic 3: The recording process (Part 2): Trial balance and 10-column worksheet; Balance day adjustments (Part 1) Topic 4: Balance day adjustments (Part 2) Topic 5: Completing the accounting cycle Topic 6: Inventory (Part 1): Recording using both the periodic and perpetual methods Topic 7: Inventory (Part 2): AASB102 – cost of inventory, cost-flow assumptions, lower of cost and NRV, inventory writedowns Topic 8: Special journals and control accounts as a lead-in to cash management (bank reconciliation) Topic 9: Non-current assets: revaluation (increments or decrements), impairment (straightforward impairment), sale of a non-current asset Topic 10: Liabilities (leases, provisions, contingent liabilities) Topic 11: Equity, income and expenses Topic 12: Critical analysis of the Conceptual Framework versus Accounting Standards

Monash

Semester 1, 2020

24 pages

9,619 words

$29.00

10

Campus

Monash, Clayton

Member since

March 2020