LAW4704 Taxation Law Notes 2017, Semester 2 (HD, Dux)

Subject notes for Monash LAW4704

Description

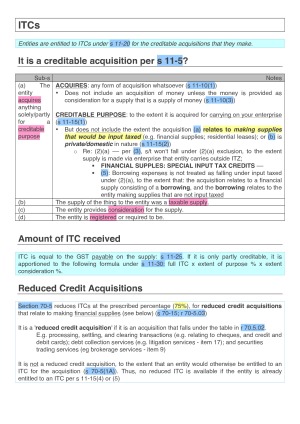

Notes for the WHOLE course (2017, Semester 2), catered towards: (1) the assignment; and (2) the final exam. They are set out in the order that your answer should be structured for a problem scenario and contain: - all legislative provisions (with citations) assessable in the course; and - brief summaries of the important principles of cases assessable in the course. Used these notes in my exam and got dux for the unit! HOW TO USE: 1. When cases are highlighted GREEN it means the case law is favourable for the taxpayer in these circumstances. 2. When cases are highlighted PINK it means the case law is unfavourable for the taxpayer in these circumstances. 3. Legislative provisions are cited in blue 4. Yellow highlight is to emphasise especially important principles NOTE - I have also included page references to the legislation book should you need to look up legislation outside the general course. This is for the 2017 version of the legislation book - so be aware that the page references may no longer be accurate. CONTENTS: (1) GST (2) Income Tax - Ordinary Income - Statutory Income - Exempt Income / Non-assessable Non-exempt Income - General Deductions - Specific Deductions - Provisions Denying or Limiting Deductions - Tax Rates - Tax Offsets (3) Capital Allowance Regime - Depreciating Assets - Balancing Adjustments - Business-Related Blackhole Capital Expenditure - Capital Works - Trading Stock - Accounting for Trading Stock (4) Capital Gains Tax This is set out in the order you should apply the CGT regime to your exam scenario. (5) Taxation of Companies & Shareholders - Capital Returns - Corporate Tax Rate - Dividends - Imputation System (Frankable Distributions) - Franking Accounts (6) Taxation of Superannuation Best of luck.

Monash

Semester 2, 2017

56 pages

22,151 words

$44.00

33

Campus

Monash, Clayton

Member since

February 2018