Flowcharts - Taxation Law - Exam Use

Subject notes for QUT LLB347

Description

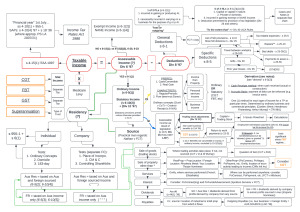

Ten (10) detailed flowcharts, created combining the semester's content including lectures, tutorials and readings. They were created for final exam purposes and helped achieve a comfortable 54/60. Due to the nature of tax law, almost all of the content should still be relevant. There are some topics ( superannuation) that were not covered in the final exam and therefore do not have a flowchart. References to separate notes are limited and only for niche areas ( Uniform Capital Allowance Rules). While I do not recommend relying fully on these flowcharts, they should be an excellent resource for exam revision and content understanding. Comparing their accuracy to the current semester's teaching and figuring out the abbreviations would be a great revision exercise. Topics covered: 1. Taxable Income Basics; 2. Residency; 3. Company Tax; 4. Income; 5. Medicare Levy & Surcharge; 6. Deductions; 7. Partnerships & Trusts; 8. CGT (A3); 9. FBT; 10. GST [Priced according to thorough accuracy check and proofreading; Taxable Income Basics flowchart as a free sample]

QUT

Semester 1, 2022

10 pages

10,000 words

$44.00