Income Tax Law III Study Guide + Comprehensive Summary

Subject notes for Adelaide COMMLAW 3500

Description

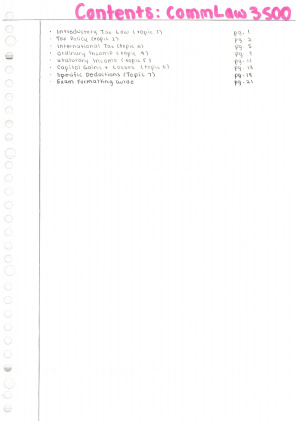

This is a comprehensive guide covering all relevant topics from the course that is a great tool for studying and helped me ace my own final exam. It is presented in the form of weekly notes summarising all of the readings, lectures and tutorial information, and includes a specific guide for exams addressing how to set out and answer exam questions for maximum marks based on tips from my teachers and things I learned along the way as well. It covers all assessable topics for the exam, including: 1. International Tax 2. Assessable Income 3. Non-Assessable Income 4. Deductions 5. Tax Accounting 6. Tax Entities It also covers topics that are not in the exam but which will help with weekly tutorial questions and assignments such as: 7. Taxation Policy 8. Ordinary Income 9. Statutory Income 10. Capital Gains Tax

Adelaide

Semester 2, 2019

26 pages

12,000 words

$29.00