Tax Law Comprehensive Notes (HD - 88)

Subject notes for Monash LAW4704

Description

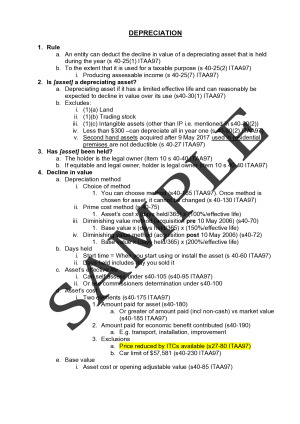

These are the notes I used in the exam. They are set up to enable quick and efficient exam answers that cover all the issues. Tax law is one of those subjects where if you have good notes you get a good mark - don't waste time studying needlessly. TOPICS COVERED: 1. GST 2. ITCs, Adjustments, and GST Accounting 3. Ordinary Income 4. General Deductions 5. Provisions that Deny or Limit Deductions 6. Depreciation 7. Trading Stock 8. Capital Gains Tax 9. Companies and Shareholders 10. Superannuation 11. Total Tax Liability Calculation

Monash

Semester 1, 2019

29 pages

8,991 words

$44.00

2

Campus

Monash, Clayton

Member since

March 2019