79017 HD Tax Law Notes

Subject notes for UTS 79017

Description

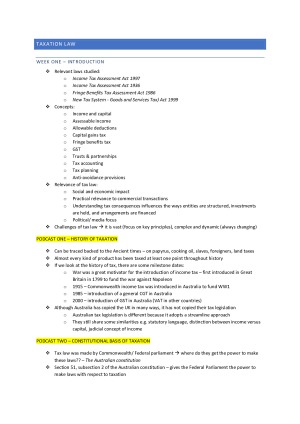

HD Tax Law notes - fully detailled. For summarised ones for the open book exam, see my other post. All topics covered with material from an array of sources. 1. Introduction 2. Overview of Australian taxation system 3. Tax formula, rates, offsets & PAYG 4. Income Tax part 1 5. Income tax part 2 6. Capital Gains Tax (CGT) 7. Fringe Benefits Tax (FBT) & Deductions (Part 1) 8. Deductions (part 2) 9. Tax accounting: trading stock & SBE's 10. Business entities, sole traders & partners 11. Trusts, companies & shareholders 12. Tax administration, tax planning, anti-avoidance, GST **Extra - Tax law quotes, cases & legislation

UTS

Summer session, 2018

41 pages

20,939 words

$34.00

12

Campus

UTS, Broadway & Markets

Member since

July 2017