ORGANISED TAX LAW NOTES

Subject notes for UniMelb BLAW30002

Description

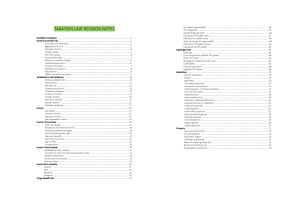

Notes include combination of lecture slides and textbook readings. Lecture topics include: - Australian Tax System - Goods and services Tax - Jurisdiction to tax (residency) - Income (from service, business, property) - Fringe benefits tax - Capital gains tax - Deductions - Company Chapter readings include: Chapter 1, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 19, 20, 21, 22, 23, 24, 25 --> notes are set out in easy to understand steps, so all you need to do is follow the steps to apply the theory --> cases are interwoven with the steps

UniMelb

Semester 2, 2018

38 pages

29,947 words

$29.00

8

Campus

UniMelb, Parkville

Member since

April 2016