MLL406 TAXATION: HIGH QUALITY NOTES

Subject notes for Deakin MLL406

Description

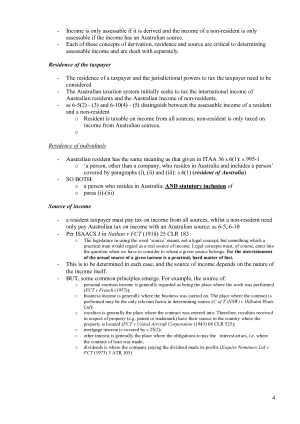

By using these MLL406 notes, I achieved a score of 76 in the exam! These concise, thorough and complete notes for MLL406 include complete summary of: prescribed textbook; case summaries; relevant legislation. Covering all topics in the unit, these materials could essentially be used as a replacement to the prescribed textbook, while being more concise, easy to read, and less time consuming. These MLL406 notes will be a fantastic supplement to your studies, and a vital resource come exam time. These are a complete summary of the MLL406 lectures, textbook, cases, legislation and topic guides. A COMPLETE SET OF MLL406 NOTES. TOPICS COVERED: TOPIC 1: INTRODUCTION TO TAXATION LAW TOPIC 2: ASSESSABLE INCOME TOPIC 3: TAXATION OF CAPITAL RECEIPTS: CGT TOPIC 4: DEDUCTIONS (GENERAL & SPECIFIC) & TRADING STOCK TOPIC 5: WHO PAYS TAX AND HOW? TOPIC 6: OTHER TAXES – FBT AND GST TOPIC 7: TAXATION PLANNING AND ADMINISTRATION

Deakin

Semester 2, 2016

62 pages

52,000 words

$29.00

Campus

Deakin, Melbourne Burwood

Member since

July 2014