BTF3931 Taxation Law Notes

Subject notes for Monash BTF3931

Description

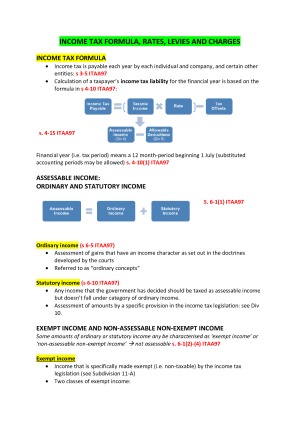

These notes are very detailed and organised according to week Topics include: Australia’s Taxation System, Sources Of Law, Income Tax Formula & Levies & Charges Residence & Source Ordinary Income: General Concepts Income from personal services & Employment Income from property Ordinary income Extraordinary and isolated transactions Isolated transactions, & Extraordinary Transactions Compensation Receipts: Individuals & Businesses General Deductions Specific Deductions Capital Allowances Capital Works Deduction: Black Hole Deductions Capital Gains Tax Goods and Service Tax (GST) Tax Offsets FBT

Monash

Semester 1, 2018

96 pages

29,620 words

$54.00

3

Campus

Monash, Clayton

Member since

February 2016