HD Taxation Law Notes 2017

Subject notes for VU BLB3134

Description

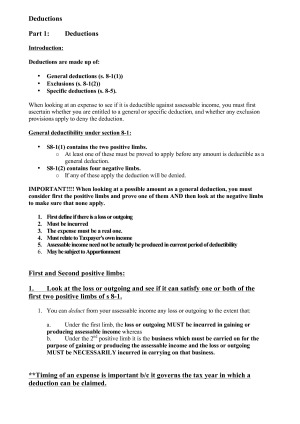

Highly detailed, accurate and organised Taxation Law notes. Cases are highlighted and legislation is bolded. Using these BLB3134 Taxation Law notes I received a HD score of 91. Topics covered: -Assessable Income -Capital Gains Tax -Deductions -Fringe Benefits Tax (FBT) -Goods and Services Tax (GST) -Trading Stock -The Taxation of Entities -Tax Planning and Tax Administration

VU

Semester 2, 2017

65 pages

24,709 words

$39.00

7

Campus

Deakin, Melbourne Burwood

Member since

February 2016

Other related notes