HD Tax Law notes (79017)

Subject notes for UTS 79017

Description

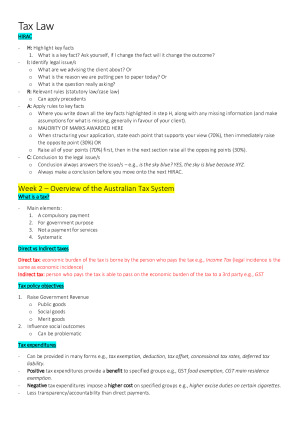

Extensive but concise tax law notes including information taken from seminars, authoritative cases and prescribed readings. They contain relevant theoretical content, supported by important case summaries and examples. I used subheadings and colour-coding to divide the material in a clear and understandable way. These notes cover all topics (1-12): 1. Introduction 2. Overview: Australian Taxation System 3. Tax Formula, Rates, Offsets & PAYG; Residence and Source 4. Characteristics of Ordinary Income; Income from Personal Exertion 5. Income from Business and Compensation Receipts; Income from Property 6. Capital Gains Tax 7. Fringe Benefits Tax; Deductions 1 8. Deductions 2 9. Tax Accounting; Trading Stocks and SBEs 10. Business Entities, Sole Traders and Partnerships 11. Companies and Shareholders; Trusts 12. GST; Tax Administration, Planning and Anti-Avoidance

UTS

Spring session, 2022

52 pages

22,907 words

$44.00

2

Campus

UTS, Broadway & Markets

Member since

June 2022